Practical guide to passive investing in the EU 📈

So you decided to be a passive investor and invest in ETFs. Most books and articles you read probably told you to invest in a simple three-fund portfolio—VTI, VXUS and BND ETFs—and that's it. However, if you are a European, unfortunately, you cannot buy those ETFs since they are not UCITS eligible. So which ETFs should you buy?

In this post, I will walk you through decisions you will have to make when you decide to passively invest in ETFs in the EU. However, I assume that you already are familiar with the fundamentals/concepts of passive investing. If you are new to investing, I recommend reading Money for Something, which is a great introduction to investing, first.

Table of contents

Asset class allocation

First, you have to choose your assets allocation. For example, if you decide to invest in bonds and stocks you have to choose what portion of each you want to buy. A general rule of thumb is to buy 100 minus your age % of stocks. The intuition is that with increasing age you want to decrease the volatility of the portfolio.

Then you have to choose a proportion of ETFs (sub-assets) in each asset class. So for example, let’s say there is one ETF for large+mid cap in developed markets and another for large+mid+small cap in emerging markets, then you have to decide what portion of each you want. (I did not find any simple rule of thumb for that. So it’s up to your risk appetite/aversion. In general, the large+mid cap companies in developed countries are less risky than the small cap companies in emerging markets.)

You can find a list of sample portfolios at Portfolio List.

My choice: 80/20 portfolio

I invest in 80/20 portfolio, i.e. 80% in stocks (90% in developed markets and 10% in emerging markets) and 20% in global bonds.

Choosing ETFs

Next, you need to select ETFs to build the portfolio. There are few things to consider when choosing an ETF:

- regulatory stuff,

- total expense ratio,

- trading currency,

- whether the ETF is distributing or accumulating its income,

- whether it's hedged against currency risk.

Regulatory stuff

If you are an EU citizen, you can buy only ETFs that are UCITS eligible. Usually, those ETFs have “UCITS” in their name, e.g. iShares Core MSCI World UCITS ETF. Alternatively, you can find it in their fact sheets.

Total expense ratio

Total expense ratio (TER) is a measure of the total costs associated with managing and operating the product. The lower the expense ratio, the better.

Trading currency

It is important to mention that the trading currency of the ETF does not influence the performance of the ETF at all. However, if you buy ETFs traded in different currencies than your home currency you will have to most likely pay some exchange fees (depending on the brokerage).

Distributing/accumulating

Finally, you have to decide between distributing or accumulating ETFs:

- If you want to generate regular income from dividends, you should choose distributing ETFs since they distribute their income regularly (monthly/quarterly/annually) directly to your brokerage account.

- If you want to build wealth it is better to invest in accumulating ETFs since they automatically reinvest the income at no extra cost so you will save on trading fees and (in some countries) you don't have to pay taxes from the dividends since they were not distributed.

My choice: EU domiciled accumulating ETFs portfolio

I invest in a three fund portfolio composed of the following ETFs:

- Bonds / fixed income (20%)

- Global bonds

- iShares Core Global Aggregate Bond UCITS ETF (IE00BDBRDM35)

- Global bonds

- Stocks / equity (80%)

- Large+mid cap in developed markets (90%)

- iShares Core MSCI World UCITS ETF (IE00B4L5Y983)

- Large+mid+small cap in emerging markets (10%)

- iShares Core MSCI EM IMI UCITS ETF (IE00BKM4GZ66)

- Large+mid cap in developed markets (90%)

Choosing a brokerage

Again, there are few things to consider when choosing a brokerage:

- ETF trade commissions,

- exchange connection fees,

- currency exchange (FX) fees,

- minimum deposit.

Besides that, you should also consider how safe and reliable the brokerage is.

ETF trade commissions

Usually, you have to pay a commission in order to buy/sell securities with a broker. However, the commission fees differ between brokers so it's best to choose a broker with lowest fees. Some brokers are even commission-free for some or all ETFs.

Exchange connection fee

An exchange connection fee is a fee for having an open position (holding an ETF) at a given exchange.

Currency exchange fee

Considering currency exchange fees of your broker is important mainly if you are planning to buy ETFs traded in a different currency than your home/account currency.

Minimum deposit

The minimum deposit is mainly relevant for new investors who want to start investing with a small amount of money.

My choice: DEGIRO

I use DEGIRO for their low fees and easy to use web trader. Below is a summary of DEGIRO fees:

| Description | Fee |

|---|---|

| ETF trades commissions | €2.00 + 0.038% |

| Commission-free ETF trades1 | Free |

| Exchange connection fee | €2.50 (max 0.25% of your account value) / calendar year / exchange |

| All foreign currencies via Auto FX trader2 | 0.10% |

For more details about the fees, see https://www.degiro.ie/data/pdf/ie/IE_Feeschedule.pdf.

From the ETFs I am investing in, only iShares Core MSCI World UCITS ETF is commission-free at DEGIRO.

Choosing exchanges

Usually, ETFs are listed on multiple exchanges so you have to choose at which exchange to buy them. I recommend choosing an exchange that lists all your ETFs in your account currency (if possible). This way you won't have to pay the currency exchange fees and will pay a connection fee only for one exchange. Besides that, it is good to choose an exchange with large market liquidity (large market capitalization) so that the shares can be easily bought/sold.

TODO Note about different tickers at each exchange.

My choice: Xetra (XETR)

If you decide to invest in the three fund portfolio (above), you can buy all the ETFs in EUR on Xetra (XETR).

TODO table with tickers for the chosen ETFs

Buying the ETFs

In order to buy the ETF for the best price possible, it is better to buy/sell it during the trading hours of a given exchange and place a limit order (instead of the market order) since placing a market order outside the trading hours might lead to much higher prices.

You can check trading hours for XETR and other exchanges here.

Step-by-step guide

Below is a step-by-step guide to placing the orders at DEGIRO.

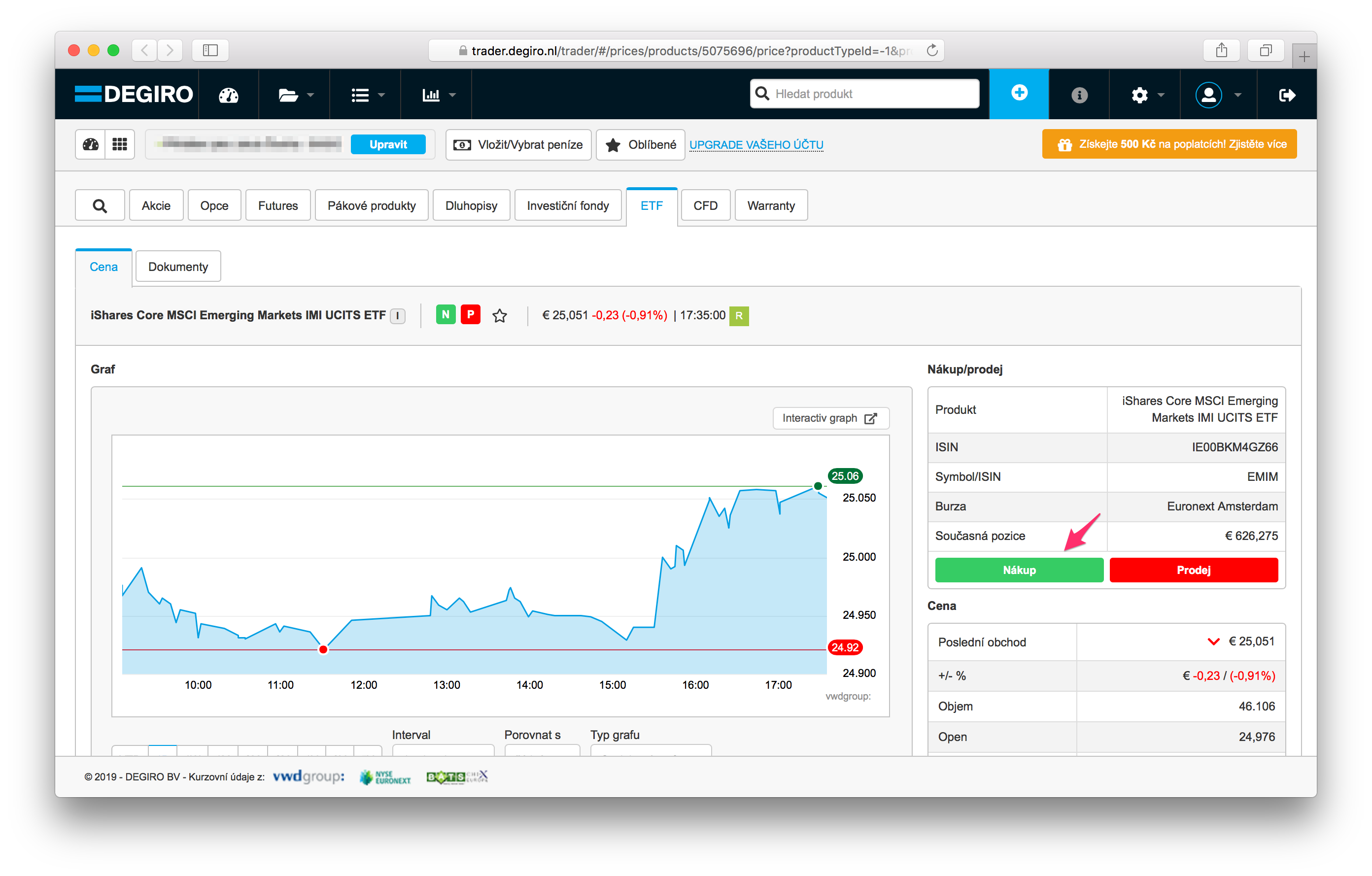

- Find a given ETF by its ISIN.

- Click on the buy button.

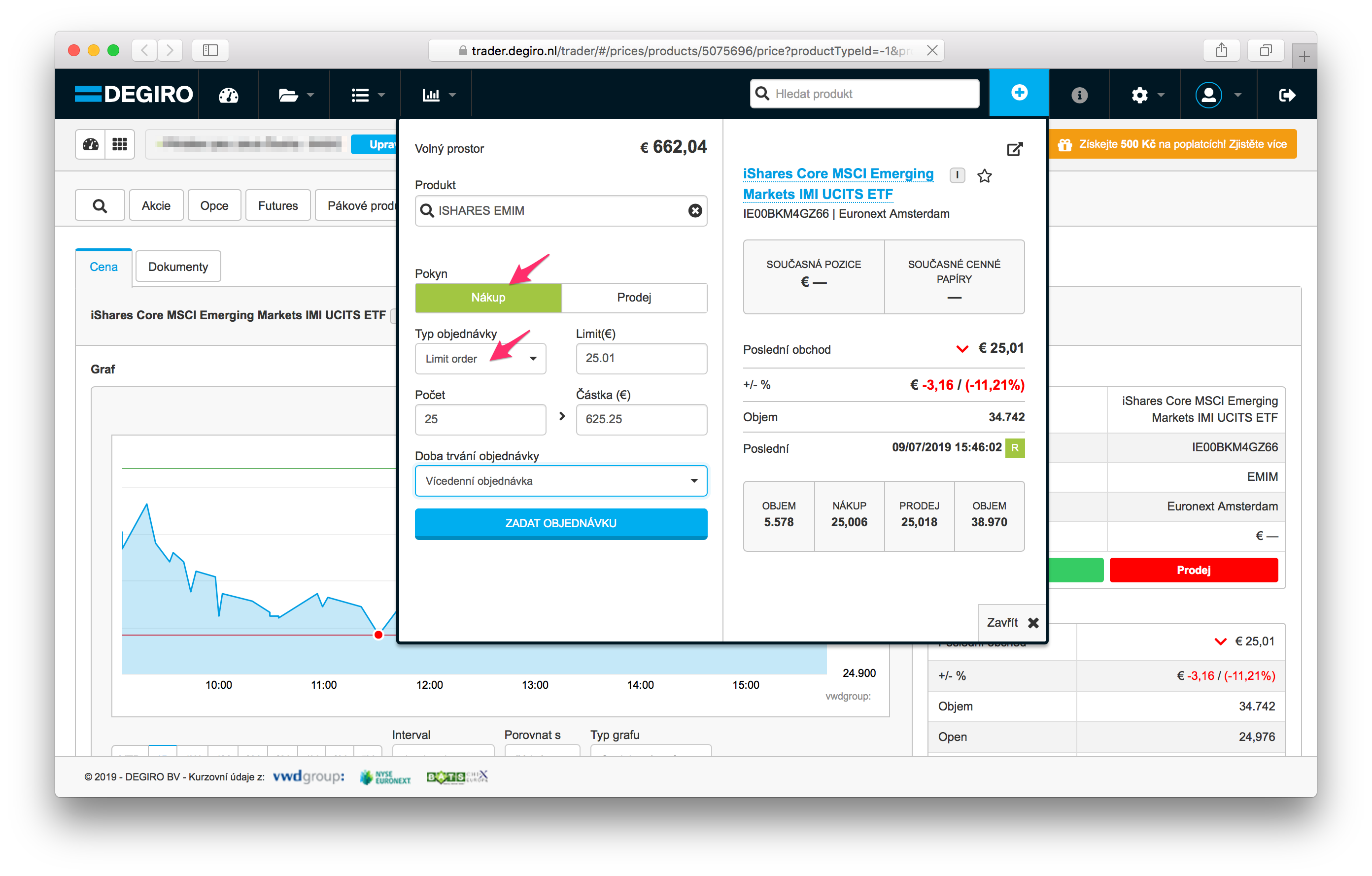

- Select “Buy” and “Limit order”.

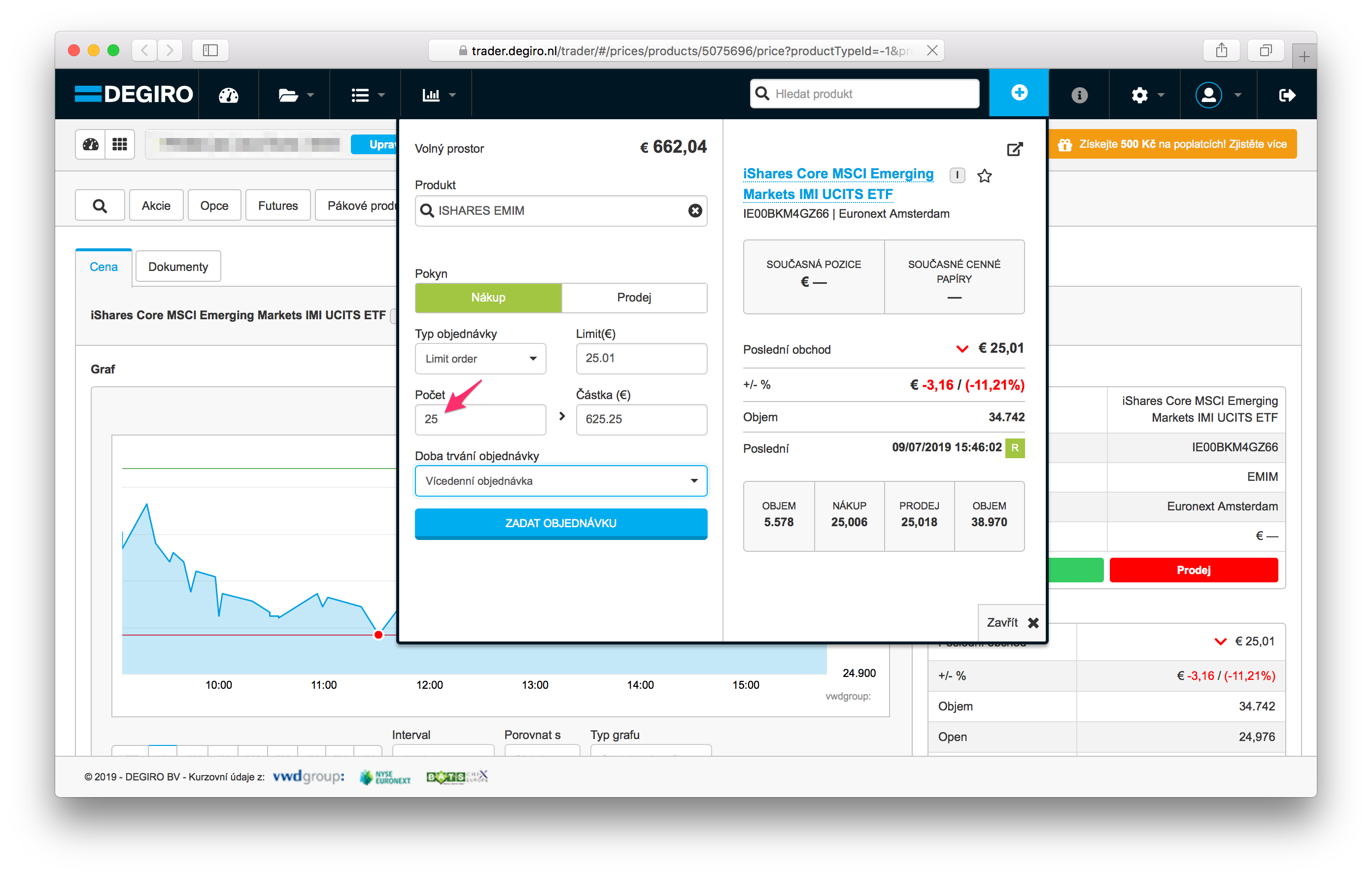

- Fill in the number of shares you want to purchase. In order to calculate how many shares of each ETF you should buy, you can use Lazy Portfolio Calculator.

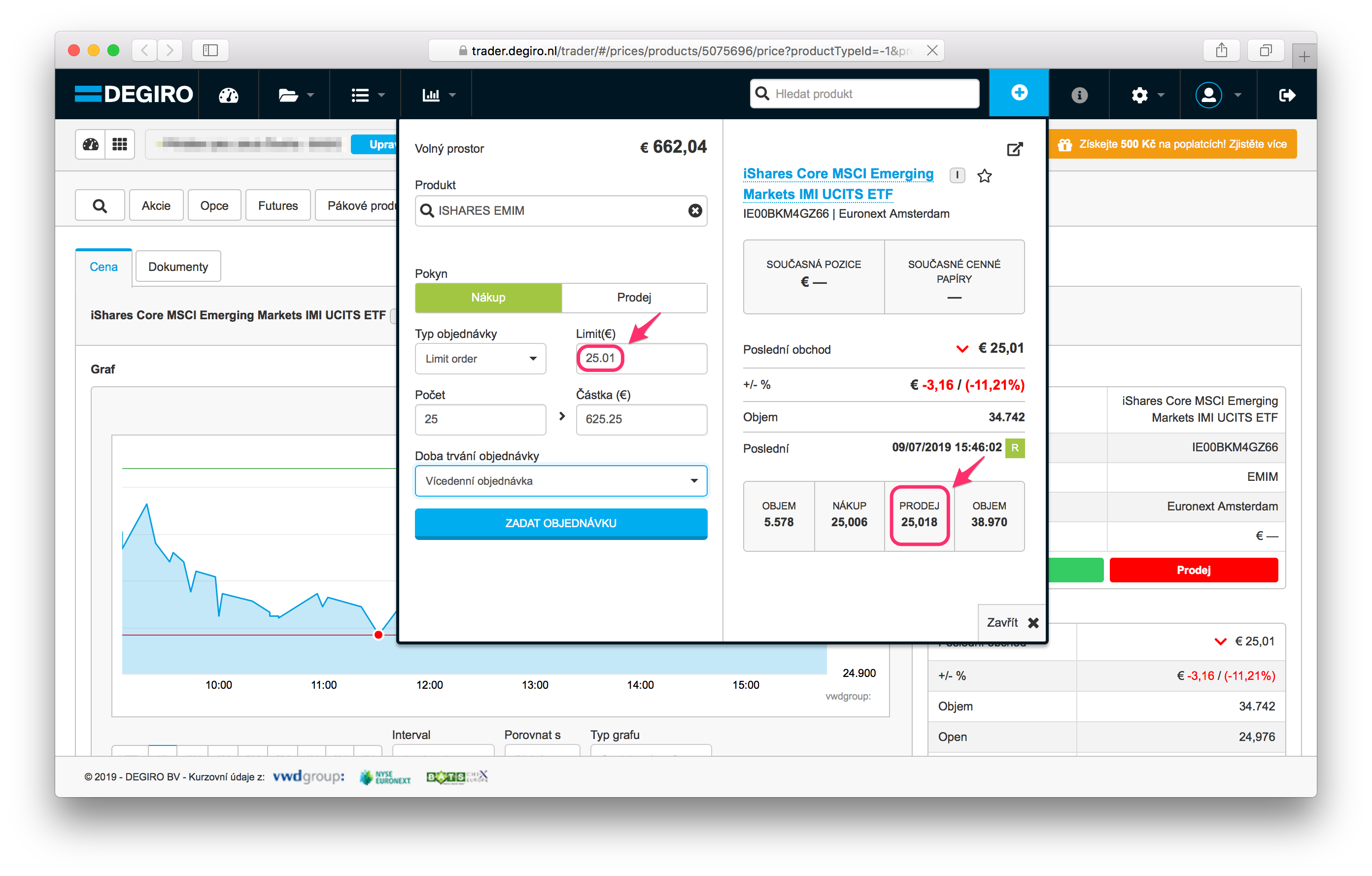

- Now, fill in the limit price based on the ask (sell) price (if you choose a lower price you will have to wait until the price goes down for the order to complete).

- Confirm the order.

- Repeat steps 1–5 for all ETFs you want to buy.

-

For the list of commission-free ETFs, see https://www.degiro.ie/data/pdf/ie/commission-free-etfs-list.pdf. ↩

-

If you deposit the money in different currency than your account currency, it will be automatically exchanged at no cost. So for example, if you deposit your money in CZK (as I do), it will be exchanged to EUR for free. ↩

If you have any comments, feedback or questions, let me know on Twitter or via email.

Thanks for reading

If you liked the post, subscribe to my newsletter to get new posts in your mailbox! 📬

Also, feel free to buy me a coffee. ☕️